Emerald

Revolutionizing Emerald Investment

with Tokenization

EMRL.D : Presentation of the token

Timeless Value

Growing Demand, Limited Supply

Access to an Underexploited Asset Class

Technical Mine & Dinamic Offering Overview

Abstract

The EMRL.D Security Token, issued by P/E Capital DAO LLC (CIK: 0001954925), represents a Regulation D (Rule 504(b)(1)(ii)) exempt security token under the U.S. Securities Act. With underwriting and market placement managed by P/E Capital (AI X), EMRL.D provides accredited investors transparent fractionalized ownership in world‑class emerald mining operations in Muzo, Boyacá, Colombia. Backed by rigorous geological data, proprietary grading standards, and blockchain‑enabled provenance, EMRL.D aligns cutting‑edge mining technology with regulatory compliance and robust risk management.

Issuer & Regulatory Compliance

EMRL.D is issued by P/E Capital DAO LLC, a Wyoming LLC formed in 2022 (CIK: 0001954925).

- Regulatory Framework: Conducted under Rule 504(b)(1)(ii) of SEC Regulation D

- Exemption Benefits: Exemption from full registration while maintaining comprehensive disclosure standards

- Market Operations: Underwriting, market‑making, and distribution handled by P/E Capital (AI X)

- Liquidity Assurance: Ensures orderly placement and liquidity management

Mining Project Description

- Location: Muzo emerald district, Boyacá, Colombia

- Site Scale: Approximately 150 hectares across multiple adjacent concessions

- Geological Setting: Predominantly the Muzo Formation—a sedimentary sequence known for high‑purity beryl mineralization within black shales and dolomitic marbles

Geological Data & Exploration

Advanced Exploration Technologies

- Drone‑mounted LiDAR mapping for precise topographical analysis

- AI‑driven anomaly detection algorithms for optimal site identification

- Geochemical assays and atomic weight spectrometry

- Core‑sampling rigs for detailed geological assessment

Mining Methodology & Infrastructure

Access Infrastructure

Spiral ramps and decline tunnels engineered to < 10° gradients for efficient haulage operations.

- Extraction Method: Selective cut‑and‑fill underground mining to preserve host rock integrity

- Equipment: Remote‑operated jumbo drills, electric LHDs, ventilation control systems

- Monitoring: Real‑time seismic monitoring for safety assurance

- Environmental Standards: ISO 14001 environmental management compliance

- Safety Standards: ISO 45001 safety standards implementation

- Water Treatment: On-site water‑treatment plants for environmental protection

- Community Relations: Active community‑engagement programs

Emerald Grading & Traceability

Proprietary EMERALD "E" Index

Advanced grading system combining colorimetric analysis, clarity scoring, and carat‑weight calibration for precise valuation.

- Blockchain Technology: Each gem's lifecycle recorded on private‑permissioned blockchain

- Provenance Proof: Guaranteed authenticity and fraud prevention system

- Traceability: Complete supply chain transparency from extraction to market

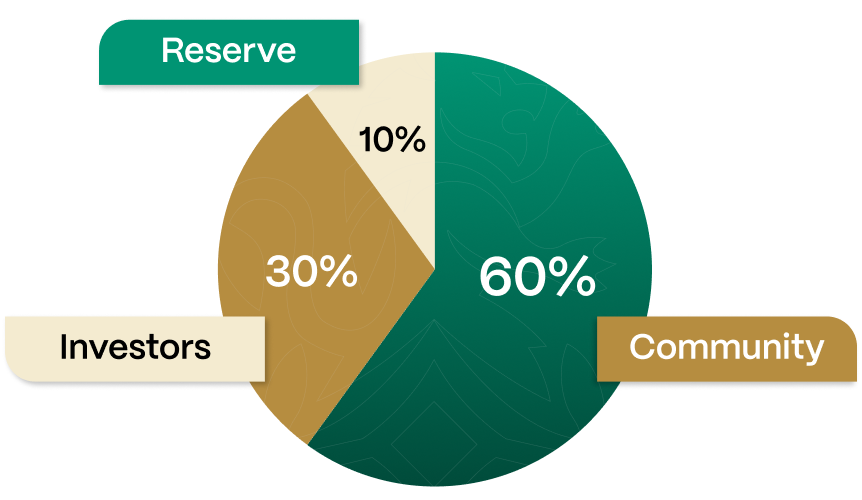

Token Structure & Use of Proceeds

Token Type: Digital security token representing equity and yield participation in mining operations

Fund Allocation

Risk Management & Investor Protections

- Operational Risks: Mitigated via redundant equipment and advanced geotechnical modeling Low Risk

- Regulatory Risks: Ongoing compliance audits, third‑party legal counsel, and transparent SEC filings Low Risk

- Market Risks: Hedging strategies and staged release of emerald inventories to balance supply dynamics Medium Risk

Risk Mitigation Strategies

Comprehensive risk management approach combining advanced technology, regulatory compliance, and strategic market positioning to protect investor interests.

Growth & Sustainability Roadmap

Expansion Strategy

Additional exploratory concessions targeting deeper uplifted zones for sustained growth and increased production capacity.

- Sustainability Focus: Renewable energy integration for underground operations

- Community Development: Strategic partnerships for local economic development

- Environmental Stewardship: Advanced environmental protection measures

- Technology Innovation: Continued investment in AI and blockchain technologies

Exit Strategy

Structured Buy‑Back: Potential structured buy‑back or secondary token market listing upon achievement of defined production milestones.

Technical Overview Summary

This technical overview demonstrates EMRL.D's unique blend of geological excellence, technological innovation, regulatory rigor, and structured investment design—empowering accredited investors with secure, transparent access to Colombia's premier emerald resources.

What Makes The Emerald Company Stand Out

A Vision to Reshape the Industry

The Emerald Company is not merely entering the gemstone market — it is positioning itself as a driving force for structural change. Its objective is to bring consistency, scale, and credibility to a sector that remains fragmented and opaque.

Market Structuring Through Supply Control

The Emerald Company is building market structure from the ground up by processing and managing its own stones. This enables them to offer a wide and steady supply of high-quality emeralds ensuring reliability, transparency, and long-term scalability.

Proprietary Traceability Technology

The company has developed in-house technology capable of identifying and verifying each emerald with 100% accuracy. This ensures traceability and eliminates doubts around provenance — key factors for institutional investors and collectors alike.

Our partnership with Provenance Proof integrates advanced blockchain technology to enhance transparency and traceability within the emerald industry. By harnessing an immutable ledger to verify each stone's origin and journey, we aim to foster a higher level of trust and accountability for stakeholders. This innovation is intended to deliver a stronger market position and create potential long-term value, though there can be no guarantee of specific results.

Groundbreaking Pricing Method

Our new emerald pricing model is designed to streamline how transactions are valued and negotiated, enabling buyers and sellers to lock in future production at predetermined rates. By establishing a transparent, data-driven framework for emerald valuation, we seek to bring greater predictability to supply chains and empower brands to plan their upcoming product lines with confidence. This approach aims to improve market efficiency, foster broader participation, and support the sustainable expansion of the emerald industry as a whole.

Led by Proven Experts

The founding team brings together seasoned professionals in mining, precious stones, and global trade. Backed by a robust international network, they are well positioned to scale operations and lead industry transformation.

An Operational Asset, Not Just a Concept

The Emerald Company's mine is already operational. With infrastructure in place, the project is positioned to generate tangible outputs and value in the near term — offering investors a unique opportunity to enter early into a structured and asset-backed initiative.

Management

Emerald Roadmap

June 1st 2025 to December 31st 2026

TARGET: END OF 2026

- Formalized mining contracts with 5 legacy emerald mines in Muzo and Quípama

- Self-funded operations through revenue generation

- Auto-sufficient business model achievement

- Established premium emerald market presence

EMRL.D RDA

Tokenomics

Presale Details

Token Name

Token Custodian

Type of Token

Network

Contract Adress

Token Distribution